2018 is proving to be an eventful year for the Fetching Freedom Family. Three weddings of close friends and family and we are on track to be officially financially independent in mere months, you guys, a full year ahead of our original schedule and before my 29th birthday, even after putting a year’s salary intoContinue reading “5 Ways Losing 50 Pounds and Saving $1M Was Exactly the Same”

Category Archives: Frugality

Personal Finance Rules Are For Dicks

Today’s post is part of the Women Rock Money movement, with a massive 42 contributors at last count alone. Yes, that’s right, 42+ kickass women dropping knowledge today. While I haven’t been able to read the others at the time of this writing, as all the posts went live today at 6AM EST, but the snippetsContinue reading “Personal Finance Rules Are For Dicks”

Does Dollars and Sense Grow Cents?

Disclaimer: Links to Amazon are affiliate links Dan Ariely has a knack for helping us understand ourselves as humans and delivering science in an approachable way. Probably best known for Predictably Irrational, a well-named tome about how humans behave irrationally (but in a predictable way), Ariely is a professor of psychology and behavioral economics. Basically,Continue reading “Does Dollars and Sense Grow Cents?”

Wow, Yeah, Unfortunately I Need to Go Car Shopping — What Now?

My condolences. Seriously, car shopping sucks. Here are a few lessons we picked up to make it less sucky, mostly focused on buying from a dealership (for Craigslist shopping, LifeHacker has you covered). [This is a continuation of our previous article, Why Did We Just Spend $1150 Repairing Our $500 Car?, which you should totallyContinue reading “Wow, Yeah, Unfortunately I Need to Go Car Shopping — What Now?”

Why Did We Just Spend $1150 Repairing Our $500 Car?

[Make sure to check out Part 2: “Wow, Yeah, Unfortunately We Need to Go Car Shopping — What Now?“] So we just spent $1150 on car repairs… oh, and the trade-in value for our car is roughly $500 (from a dealer; we could surely get quite a lot more selling it ourselves, but probably still lessContinue reading “Why Did We Just Spend $1150 Repairing Our $500 Car?”

Six Steps to Saving Money by DIYing Everything Like a Bad-ass Engineer

In my freshman engineering seminar, there was one phrase forever drilled into my head: “Engineers Solve Problems (ESP™).” ESP was the one thing that brought all the disciplines together – from six sigma-ing industrial engineers to code monkey computer engineers (engineers can be super cliquey). So how can you be like an engineer? You guessed it –Continue reading “Six Steps to Saving Money by DIYing Everything Like a Bad-ass Engineer”

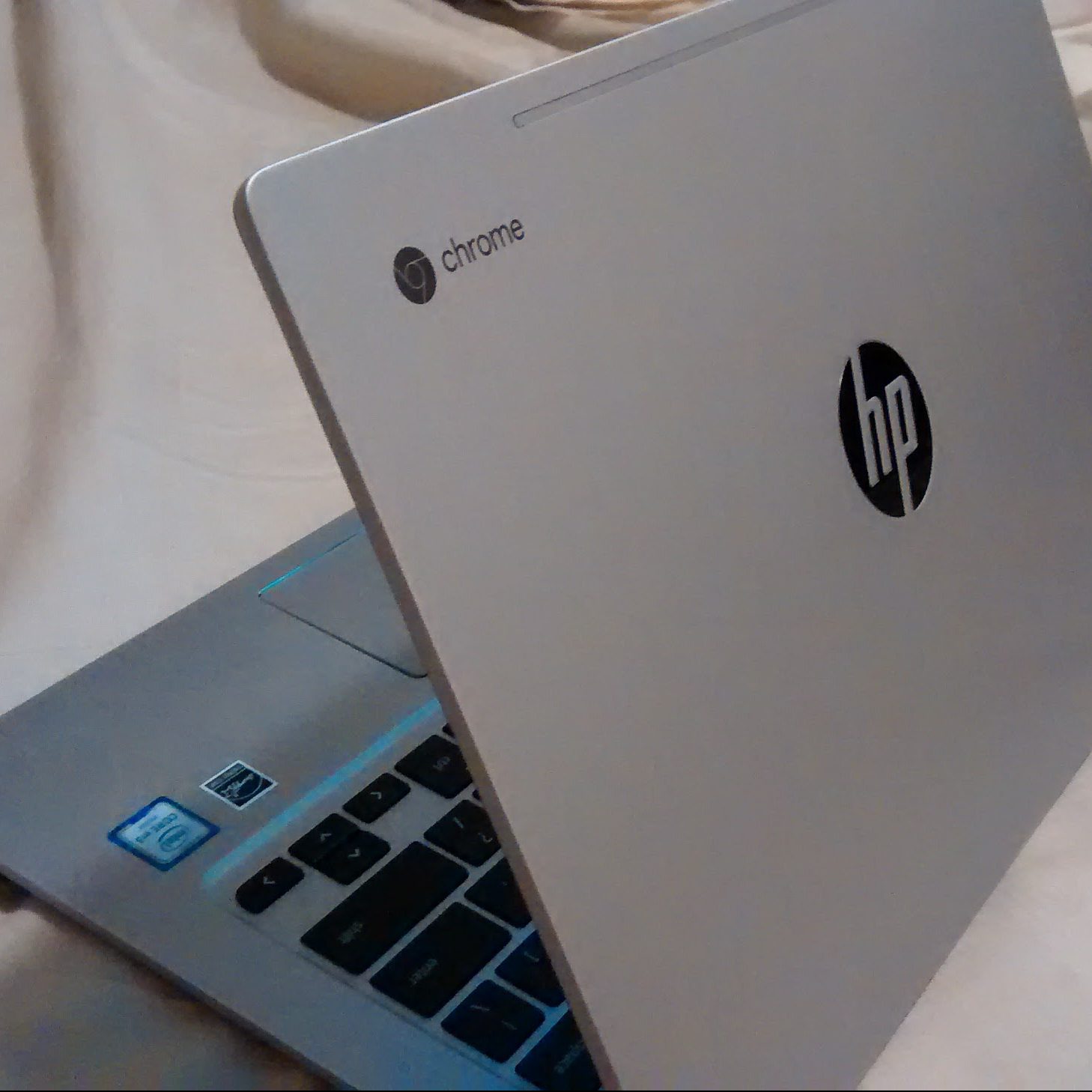

To Chromebook or Not to Chromebook

I just got a new computer. And I love it. I primarily wanted something for writing (this blog + other random projects), and for general checking email, browsing the web and the like. I needed something lightweight and portable, something I could pick up on a whim for hours of creation. I went with aContinue reading “To Chromebook or Not to Chromebook”

Free Events in and Around Boston

The weekend before last we went to the Boston Local Food Festival on the Greenway in Boston. While we used the opportunity as our one fancy “nom out” for the month (see this post for details on our monthly adventures), there were loads of free samples, a cooking competition, and demonstrations all for free. We even gotContinue reading “Free Events in and Around Boston”

Saving Money on Money (International Transfers)

This is not a sponsored post, but there are affiliate links to TransferWise, a company we enthusiastically support and reached out to. I love technology. So much information at our fingertips, such almighty power compared to twenty years ago. So why is so much banking technology awful? At work I could spin up a network ofContinue reading “Saving Money on Money (International Transfers)”

Be Lazy, Eat In: Frugal Kitchen Breakfast Edition

I am spoiled. Fergus is in charge of cooking, and for good reason: his food is delicious (plus he enjoys cooking). Some mornings I literally wake up to the offer of breakfast in bed. Yet as I write this Fergus, is away on a business trip. And I can’t cook. And I hate cleaning theContinue reading “Be Lazy, Eat In: Frugal Kitchen Breakfast Edition”