At the start of the pandemic, I lost my job, around the time we reached financial independence.

Category Archives: Happiness

On Being Accidentally on FIRE

Shortly after graduating college, I knew I wanted to pursue financial independence, retire early (FIRE). Now I’m 30, financially independent (even with recent crazy market swings), and recently laid off (thanks coronavirus). Am I my goal?

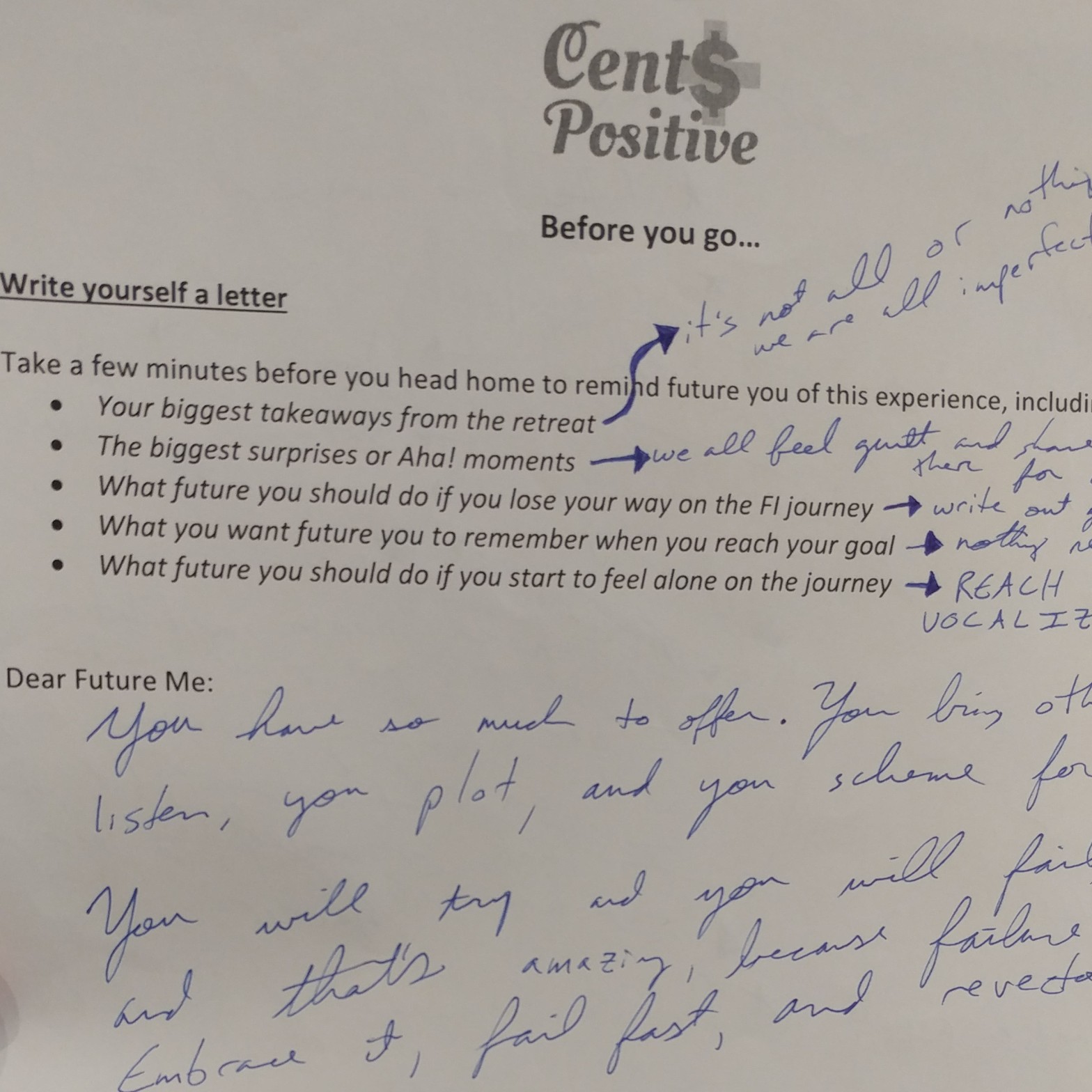

My Cents Positive Letter to My Future Self

Still time to enter the giveaway for a signed, hardcover copy of Dollars & Sense! All you have to do to enter is leave a comment on this post by midnight tomorrow, Thursday, November 8th. Cents Positive is a women’s financial independence retreat, where those on the path to financial independence (or already there) canContinue reading “My Cents Positive Letter to My Future Self”

Why I’m Not Buying a Ticket to FinCon19 (& FinCon18 Recap)

Apologies for not linking out to all the amazing people and friends I saw at FinCon18! My internet is very dodgy currently, making my usual habit of 20+ tabs for hyperlinking purposes untenable. Know that I’m thinking of you. ❤ At the end of FinCon17, I immediately bought my ticket for FinCon18. Meeting so manyContinue reading “Why I’m Not Buying a Ticket to FinCon19 (& FinCon18 Recap)”

5 Ways Losing 50 Pounds and Saving $1M Was Exactly the Same

2018 is proving to be an eventful year for the Fetching Freedom Family. Three weddings of close friends and family and we are on track to be officially financially independent in mere months, you guys, a full year ahead of our original schedule and before my 29th birthday, even after putting a year’s salary intoContinue reading “5 Ways Losing 50 Pounds and Saving $1M Was Exactly the Same”

Personal Finance Rules Are For Dicks

Today’s post is part of the Women Rock Money movement, with a massive 42 contributors at last count alone. Yes, that’s right, 42+ kickass women dropping knowledge today. While I haven’t been able to read the others at the time of this writing, as all the posts went live today at 6AM EST, but the snippetsContinue reading “Personal Finance Rules Are For Dicks”

Does Dollars and Sense Grow Cents?

Disclaimer: Links to Amazon are affiliate links Dan Ariely has a knack for helping us understand ourselves as humans and delivering science in an approachable way. Probably best known for Predictably Irrational, a well-named tome about how humans behave irrationally (but in a predictable way), Ariely is a professor of psychology and behavioral economics. Basically,Continue reading “Does Dollars and Sense Grow Cents?”

2017 Recap, 2018 Goals, and a Guest Post

Happy 2018, y’all! As I’m writing this, Fergus, Fluffster, and I are currently sitting (and one of us is whining) in a Red Roof Inn wondering what the weird sound coming from the bathroom is. [Future Felicity here: still no clue what that sound was…] What do two nerds who don’t celebrate Christmas do withContinue reading “2017 Recap, 2018 Goals, and a Guest Post”

Donating a Year’s Salary to Our Donor-Advised Fund

We started this year dedicating ourselves to $2,680 in charitable donations, ten times our previous, pitiful contributions. Just a few days ago we officially fully funded our donor-advised fund, meaning we could theoretically maintain that $2,680 each year for the rest of our lives (we haven’t touched on too many specifics of our spending onContinue reading “Donating a Year’s Salary to Our Donor-Advised Fund”

Is Every FIRE-Seeker a Multipotentialite?

First off, can we all agree that “How to Be Everything” is an amazing title for a book? If you read enough self-help or management books, after a while they all seem to be just the same message repackaged over and over again (Not that anything can be totally original, but you know what IContinue reading “Is Every FIRE-Seeker a Multipotentialite?”