We started this year dedicating ourselves to $2,680 in charitable donations, ten times our previous, pitiful contributions. Just a few days ago we officially fully funded our donor-advised fund, meaning we could theoretically maintain that $2,680 each year for the rest of our lives (we haven’t touched on too many specifics of our spending on here, but for context, we live on a little more than $36k a year, including rent, and additionally give $10k to family each year).

According to the 4% rule of thumb, we’d need $67k, but we rounded up to $70k for good measure. Coincidentally, my starting salary as a new engineering grad six years ago was $67k! Due to the magic of compounding returns and some nice salary bumps along the way, this contribution only delays financial independence by about six months for us, and we should still be able to reach our goal of 2019!

Donor-Advised Fund (DAF) for Early Retirement

A DAF is a fantastic way to make your charitable contributions go farther, especially when you’re looking to be Financially Independent and Retiring Early (FIRE). For detailed specifics, I’d highly recommend checking out Michael’s post about DAFs on Nerd’s Eye View. And, of course, before making any financial decisions, seek out advice from a professional as opposed to listening to a random stranger who posts far too many dog photos on her site.

The Donor-Advised Fund Basics:

- Select a DAF provider, open and name your fund

- Make irrevocable contributions during high-income years (No take-backsies)

- Cash, appreciated equity (stocks), or even art and other assets can be contributed

- Itemized deductions can be taken on total value of contribution (up to 30% of AGI for equities and up to 50% for cash for most looking at DAFs, see IRS Publication 526 for details)

- Capital gains on equity are not taxed

- Invest the contributions in your fund

- ideally in low-cost index funds

- Tax-free gains forever

- Suggest charitable distributions throughout your years (minimums depend on DAF provider)

Donor-advised funds make your charitable contributions go farther, especially if you’re in a high-income situation. In fact, in very high-income situations, it could cost you only about $58k to donate $100k (or even less!), as shown by the Physician on FIRE. He also has a list of bloggers with DAFs on his site you can check out, near the end of this post.

One of my fav bloggers, Tanja, from Our Next Life (you see that, Tamagotchi, I spelled your name right this time on the first try! Do I get a gold star? :D), has a powerful post about their DAF and how they’re using their superpowers for good.

Favorite Little Known Things About DAFs:

- You can name your fund *basically* whatever you want. We considered calling our fund “Fluffster” or equivalent but decided against it. Also eliminated: “Totally Innocent Fund”, “Non-Suspicious Fund”, “Fund Fund,” “Evil Incorporated”, and “Slush Fund”

- You can donate anonymously (or semi-anonymously). This is especially useful if you also hate charity spam. Donating to most places apparently puts you on a list of People Who Have Money that other charities use to seek donations. The ones we’ve received letters from are mostly charities that don’t have the best track record in terms of effectiveness or overhead costs. Hmm, I wonder why?

- You can change your fund name *pretty much* whenever you want. Rethinking a rejected fund name? Go for it. 😉

- (1), (2), and (3) can combine to very humorous ends. Is it wrong to want Doctors Without Borders to receive a donation from The Border? Or to donate to Fluffster’s rescue from the Fluffy Puppies and Kittens and Penguins Oh My fund? Alright, maybe, considering that would increase overhead costs at your fund provider, but a girl can dream, okay?!

New Tax Plan Changes

Unless you’re living under a rock, you’re probably aware of the new tax changes afoot for 2018. They’re a lot. It’ll take tax professionals months to even fully understand them.

One big change is the standard deduction increase:

| 2017 | 2018 | |

| Standard Deduction (Single) | $6,350 | $12,000 |

| Standard Deduction (Married Filing Jointly) | $12,700 | $24,000 |

This will mean more tax savings for most (at least before they expire in 2027, after which the majority will pay more), but this also means itemizing and taking tax advantages with charitable contributions will be harder and less realistic for most.

For example, it would be frustrating if you came really close to the new standard deduction ($24k for married filing jointly). I mean, the Jones family could have nothing to deduct in a state with no income tax, meanwhile, you’re sitting over here as a married couple with $10,000 in state taxes, $10,000 in mortgage interest, and have been donating $3,000 to your favorite charities each year. You’re doing all the “right” things, buying a house, donating to charity, and yet the Jones’ do none of those things and pay the same amount in taxes.

In a lot of ways, the new tax plan disincentivizes charitable giving, as it would take much larger donations to move the needle on taxes. For 2017, that same family with $10k in state taxes and $10k in mortgage interest is already above the standard deduction, meaning their $3k in charitable contributions are already fully tax-advantaged, giving them a “discount” on charitable giving equal to their marginal tax rate.

Two other big changes that would affect deductions are limits to the mortgage interest tax deduction (can only claim on first $500k of property now, down from $1.1M, and cannot deduct for a second home), and limits to the state and local tax (SALT) deduction (can only claim up to $10k total starting in 2018).

Maxing Out Our Taxable Benefits

Also known as “bunching.”

Normally, we don’t have a lot to itemize. We have state taxes, but below the $12,700 standard married filing jointly deduction for 2017. Plus we rent, don’t have kids, don’t have many business expenses at all, and have no major medical expenses (thank goodness!). With the new 2018 standard deduction of $24,000 for married couples (and limit of $10k for deducting state taxes), we’d have to donate over $14,000 in any given year to see any benefit to itemizing deductions.

However, if we fully fund our DAF all in one year, we can get tax savings on the vast majority of contributions, maxing them out all in one year to receive the maximum tax advantage. You can do a similar tactic by donating a big chunk every few years if you don’t want to contribute all at once.

Our Total Tax Savings (2017)

Our state taxes are probably going to end up around $10k this year. Thus, given the 2017 standard deduction of $12,700 for married filing jointly, any charitable contributions we make (up to the 30% of AGI for equities, 50% of AGI for cash) over $2,700 will save us at least our marginal tax rate (plus more if contributions contain appreciated stock, as those contributions to a DAF are not taxed).

This means $67,300 * (28%) = $18,844 in federal tax savings just by itemizing, and we additonally saved roughly $2.5k in capital gains tax. Our $70k contribution only cost us $48,656.

Are You Screwed If You Missed the 2017 Deadline?

Nope! You can still benefit by bunching, just not quite as much as this year.

If you’re looking to FIRE and are currently in high-income years, you can still get lots of tax savings by making large contributions right before “retirement,” presumably some of your highest income years.

In our example, if we instead made the $70k contribution in 2018, the standard deduction would be $24k for married filing jointly, and the maximum deduction we could take for state taxes would be $10k (which coincidentally happens to be about what we would pay regardless). Thus, any charitable contribution over $14k would beat the standard deduction.

Donating $70k would translate to federal tax savings of $56,000 * 24% (Our new marginal tax rate in 2018) = $13,440. We would still not have to pay the $2.5k in capital gains tax. Our $70k contribution would cost us $54,060.

How Long Does it Take to Donate to a Donor-Advised Fund?

This is a question I didn’t even know was important until very recently when going slightly mad trying to make our gift of equities before 2017 was up. The answer is really that it depends on how many other people are requesting at the same time, what you’re donating, from where, and who’s initiating it.

- Donating Cash

- Super quick! It may take a few days to first set up an account, but after that, as long as contributions are initiated in the current tax year, they will count (might change depending on DAF provider).

- Donating Equities

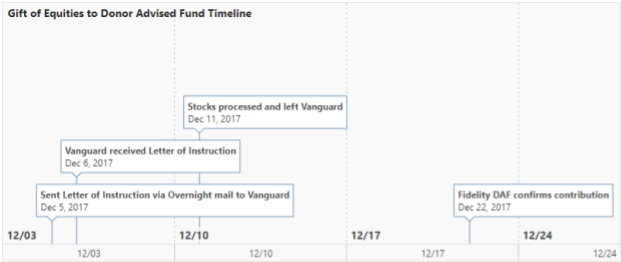

- Longer! We have a Vanguard brokerage account we were looking to use for the donation, and our DAF provider is Fidelity. We sent our letter of instruction in via overnight mail to Vanguard on December 5th, which arrived at Vanguard on December 6th. The stock was processed and left Vanguard on December 11th. We received the contribution confirmation from Fidelity on December 22nd. (most advice seems to say to initiate gift transactions from your DAF fund provider, but customer service indicated that filling out a letter of instruction to your brokerage account is the faster way to receive funds.) See the timeline below for a visualization.

- November 27th was the last day to initiate from Fidelity and ensure the contribution gets in for the tax year 2017. So assume any contribution of equities will take five weeks at the max.

- If your brokerage account provider and DAF provider are the same institution, the process should be much quicker.

2017 Tax Savings Still to Be Had!

If you have some extra cash, already have a donor-advised Fund, are itemizing this year, and it’s December 30th or earlier, it would make a ton of sense to make a contribution before the year is up!

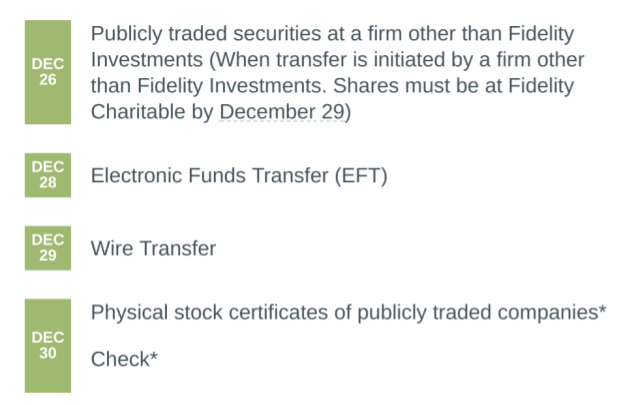

This will change depending on DAF provider, but here are the last-minute deadlines according to Fidelity:

Even if it’s not possible for you to make a donation this year, donor-advised funds are still a great way of saving on taxes in high-income years regardless. If we do ever profit from this blog, we’ve pledged to give 50% of all profits to either GiveWell or another awesome charity of readers’ choice. Heck, why not check out the Fluffster Recommends page for ideas?

So do you have a donor-advised fund (or plan to open one in the future)? Also what would be the most hilarious mixture of DAF name and charity name?

This is a great primer on Donor Advised Funds. Congrats on setting one up! We plan to, sometime in the hopefully-near future, and this was a great post to read as I still haven’t delved into all the rules and regulations concerning how to set them up.

LikeLike

Thanks, Laurie!

Yeah, they can be confusing at first — it definitely took us a while to decide which provider to go with and when to actually take the plunge. Thankfully customer support has been pretty fantastic so far with our donor-advised fund. 🙂

LikeLike

Awesome post! This is something I only started looking into this month and didn’t get the ball rolling in time to do it in 2017. The difference in how donated stock is handled for short-term vs long-term holdings also further complicates matters.

That’s awesome about the ability to change the name whenever. I was unaware of that, but it makes it that much easier to get started now (or well, next year)!

LikeLike

Thanks, Adam!

Haha, we haven’t tried changing the fund name, but it’s just a simple form 🙂

Oh, I didn’t even think about short-term holdings for the DAF, since the ones we’ve held the longest have had the most gains / made the most sense to donate because of taxes. It would make sense that sometimes that wouldn’t be the case, though!

LikeLike

I just set mine up ! I did a vanguard to vanguard charitable set up and contribution in one day! (physician on fire shows how to move ‘grant funds’ from one DAF to another in case I want to switch to Fidelity later).

Two things I learned after I did the donation:

1 – for equities— you only can take the current valuation as a deduction if you have held the shares for more than one year. So, if you bought 1000 worth of a fund in January 2017 and you just donated it, the value of the donation is 1000 (cost basis) even if it is currently worth 1600. Watch out for dividends that reinvested!

2- the max for a deduction on equities differs depending on how long you’ve held them… if less than a year, you can donate 50% AGI..but on those held longer than a year, only 30% AGI. It does look like you can rollover excess deductions for the next year.

Its also the first time we are itemizing. Ill probably use an accountant to do taxes this year just to double check. These donations require some extra documentation and at least one additional form for taxes.

LikeLike

Nice!! Well done, Elisa ^_^

Good notes for short-term equity holdings. We were using Specific Identification (specID) for our cost basis, but we changed to First In, First Out (FIFO) to make filling out the contribution form a bit easier, and also so the stock we donated would have the highest gains associated with them. Huh, I’ll have to check how reinvested dividends play into it, though! Still so much for me to learn.

LikeLike