Last week I had the opportunity to cover Mad*Pow‘s Financial Experience Design (FXD) conference in Boston, a place where design leaders serving banks, insurance providers, educational nonprofits, and investment companies come together to talk about how to optimize experiences for their customers. For a play-by-play, check out #FXD2018 and my thread on Twitter.

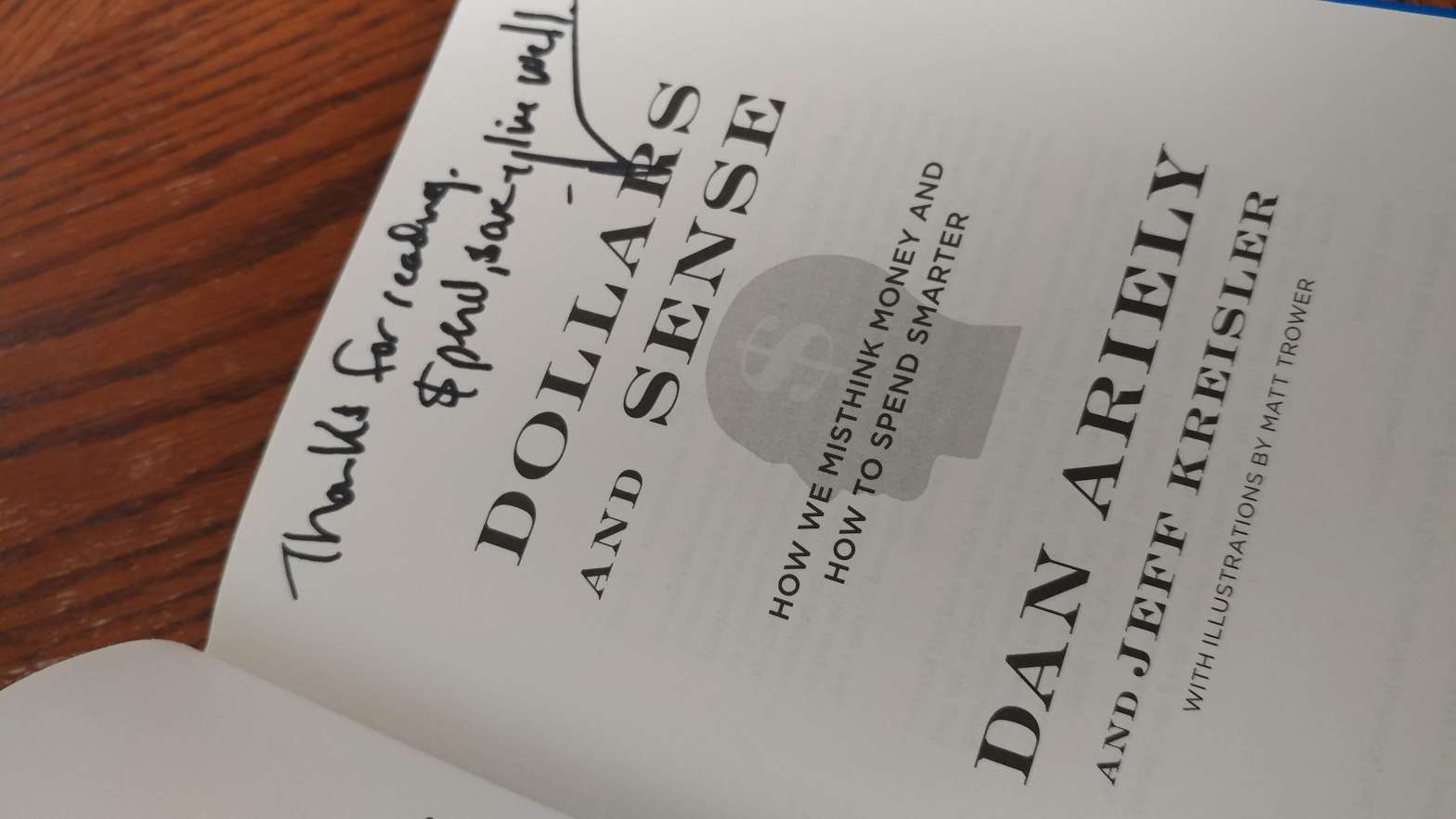

Stick around to the end of the article for directions on how to enter to win a signed copy of Jeff Kreisler‘s Dollars and Sense.

1 Health and Wealth

Day 1, at the pre-conference leadership summit, during the very first discussion, the inextricable link between health and wealth came up, and it kept coming up throughout the conference, as evidenced by Twitter.

I know this is a financial experience conference but all I can think is how this applies to healthcare/human services design… #fxd2018 https://t.co/lhiotQdFy7

— Sean Erreger, LCSW (@StuckonSW) October 25, 2018

Unless you’re extraordinarily lucky, you’ll have medical scares throughout your life (if you’re unlucky, you might have a chronic invisible disability). Part of Financial Wellbeing is being able to pay when a surprise medical bill comes.

The bigger, more annoying part of financial wellbeing? You cannot force someone to save, just as you can’t force someone to be healthy. I am down around 70 pounds from my highest weight right now, and it’s not because of lectures on the BMI scale. Serving today’s savers and investors means giving them tools and resources that empower and meet them where they’re at in their financial journeys.

2 Millennial Communication Gap

“Millennial” is still such a maligned word, and there were several discussions about how to design and appeal to this generation at FXD.

The strangest part to me is that as of this writing, millennials are roughly between 22-37 years old, which is a vast fifteen-year spread of people (including myself). Some millennials have just graduated college, whereas others have four kids and holiday in Paris. We’re not “those young kids” anymore; we’re your coworkers and friends.

This communication gap is not just being felt by financial institutions. While I was performing my best Professional Live Tweeter impression during the conference, the quote, “Usefulness is 1.5 times more important than usability,” was the most retweeted by my largely-millennial audience. Companies don’t know how to appeal to millennials, and millennials don’t feel like they’re being heard. What gives?

As Melissa Gopnick of Commonwealth said, “It’s not a problem of knowledge; it’s a problem of options.” Traditional financial institutions started out with vastly different consumers. The 1960 dream of a single income household, white picket fenced house, 2 ½ kids, and a stable, clear career path is now an outlier.

Design the conversation and meet people where they are — Marli Mesibov (Mad*Pow)

Telling someone to care about retirement contributions when they’re struggling to pay rent or have staggering student loans is simply not going to work well.

Financial institutions could learn a lot from speaking to millennials like Kara Perez, who paid off $25,302 in student loans after starting off making $16,183 in 2013. She’s now focused on helping low-income women through workshops and tools like her new Values-Based Budgeting Workbook. There’s also Steven Hughs, who started his financial journey with seven maxed out credit cards, two repossessions, and an eviction. He’s now a Certified Financial Education Instructor and helps college students start their finances off right.

There are so many millennials with stories to tell in the personal finance space. I will happily serve as blog sommelier if it means fixing the millennial communication gap with financial institutions.

Book Giveaway!

I have a brand new, hardcover copy of Dollars & Sense to giveaway to one lucky reader, signed by author Jeff Kreisler. To enter, all you need to do is leave a comment below (by November 8th) answering the following questions:

- Where you are in your life and/or financial journey (e.g. Gen X focused on paying off debt)?

- What do you have to say to financial institutions about how to better serve you?

Hallo Humans,

Is me, Fluffster.

1. I is a retired canine focused on spreading fluff in the neighborhood.

2. They need to open their doors to me, and hire many more humans to pat me.

If I win book, I expect Jeff Kreisler to deliver both pats and book.

Harumph,

–Fluffster.

LikeLike

Fluffster, I’m sorry to say, but you’re not eligible to win. Also, you’re a dog, and this book is about humans.

LikeLike

I’m on the journey to FI! I need them to talk to all levels of earners, specifically women.

LikeLike

The levels are so important! From the conference, it seemed like many companies are starting to shift focus from purely the high net worth individuals. Hopefully there will be more visible changes soon!

LikeLike

I’m a millennial who’s at the building wealth stage of my life. I have a career I love but am trying to balance saving for the future with right now spending.

I want more relatable voices coming out of the finance world. It can be intimidating when you’re just starting out to go in and talk with someone you can’t relate to.

LikeLike

100%

It’s so important to find people you can relate to — part of why the Cents Positive has already been so great!

LikeLike

I’m Gen X and on my journey to financial independence.

Re: financial institutions — my suggestion is not relevant to me. I wish they would drop the minimums and fees for traditional accounts to help out low income individuals and families. They could perhaps provide alternatives to immoral (IMHO), expensive payday loans. Wouldn’t it be great if they would act as a fiduciary for all of us?

LikeLike

Jen, you are so right! There are tons of low-cost services for people with more than $X of savings or investments, but not many for those just starting out or struggling. *Hopefully* financial companies are heading towards providing more services for those not already loaded…hopefully.

LikeLike

I’m a late Boomer (born at the end of 1957) who went broke during a protracted divorce after a long-term abusive marriage. Didn’t get a university degree until age 52, and I haven’t had a regular job since 2002. Freelancing has meant great flexibility, but it’s also been challenging to pay off divorce-related debt and save for retirement.

Now I’m at the point where I want to work *less* rather than scramble constantly (hint: my delightful partner has retired and I wanna be with him!) but I need to be realistic about how much work I can afford to shine on. People in my family are generally very long-lived and I don’t want to be a burden on my only child.

Mostly I want financial institutions to treat me and all women as smart enough to understand that we need options, and then giving a VARIETY of those options. What works for me as an older woman with no kids to support won’t necessarily work for a single mom, or a woman with a chronic illness, or a woman who lives in an economically depressed area and can’t afford an education.

No one-size-fits-all answer exists. Get creative — and compassionate.

LikeLike

Donna,

Thank you so much for sharing your story, and you’re so right about variety being key. That was definitely a discussion point at the conference — the need to listen to the different needs of customers, vs. wondering how to get customers using a pre-existing product. Fingers crossed that decision makers agree.

LikeLike

I’m a millennial who is working towards financial independence. I needed financial institutions to speak in clear language, be upfront about fees and their impacts, and not judge my generation.

LikeLike

Oh, you’re so right about some services feeling judgy! I know plenty of people that don’t use tracking apps because the apps make them feel bad about themselves. Clear language is also so important — I think even in the last 5 years there’s been a lot of progress on that front.

LikeLike