2018 is proving to be an eventful year for the Fetching Freedom Family. Three weddings of close friends and family and we are on track to be officially financially independent in mere months, you guys, a full year ahead of our original schedule and before my 29th birthday, even after putting a year’s salary into our newly minted Donor-Advised Fund.

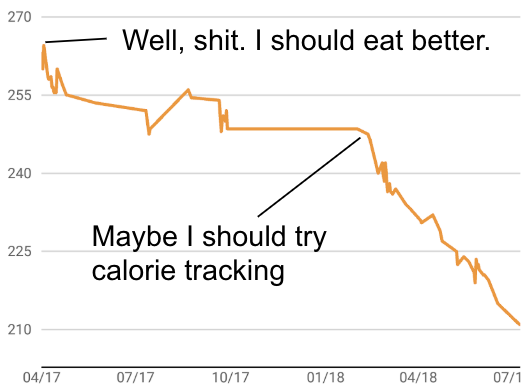

Not to mention I will be a speaker at FinCon (affiliate link for tickets, though they have community passes too), attending the inaugural Cents Positive retreat (sold out, but sign up for their list serv for details on the scholarships), taking an eight week sabbatical (including three weeks in and around the beautiful Acadia National Park in Maine), and I’m on track to lose over 50 pounds this year (bringing me down 67 from my highest weight over the last two years)!

Unlike frugality and personal finance, healthy habits do not come naturally to me. Losing weight with diet and exercise always sounded reductionist and didn’t seem to apply to me. Vegetables were my friends, after all, and red meat was never part of my diet; if I already ate my greens, how could I possibly lose weight? Plus running is just awful. I’d rather have some extra weight than have to go for a run every day. I don’t eat any different from my friends, and they’re not overweight. It’s obviously just the way I am, right? (Spoiler Alert: wrong!)

It took unknowingly gaining 30 pounds in a year (and, okay, the Secret Eaters TV series if I’m being honest) to really get me to make a conscious change, and in the journey I’ve realized there are an insane number of parallels to personal finance and the journey to financial independence.

It Comes Easily to Some

There are some people that are just naturally thin (or naturally whatever the beauty standard of the day is), just like there are some people who are just frugal by default. In order to be really fit, financially or otherwise, you will have to work for it, but it’s undeniable that some people have a bit of an easier go of it. For me, frugality comes easily, but I will always have thunder thighs.

You are not doomed, even if you aren’t naturally thin, or weren’t born into upper middle class white picket fence suburbia. We just need to do our best with the hands we were dealt (and help others if we’re able).

Tracking Works

Weight loss and personal finance are both just input/output systems. If you burn more calories than you consume, you’re going to lose weight. If you spend more than you make, you will go into debt. The real magic in tracking calories or spending doesn’t come from solving a simple equation, but simply forcing yourself to confront your choices.

Even though we started our financial journey in a good place with no debt and some savings, we were able to cut out hundreds of dollars of spending in eating out each month that we don’t miss. “Track your spending” is my first piece of advice for any friend that asks. In my small sample size, everyone has $200-$1000 per month that they had no idea they were spending, and that’s just for the largest budget sleeper agent item each.

Despite knowing how well the simple act of tracking spending worked for savings, I’d never really tracked calories. I was worried that counting calories would bring me down the dietland rabbit hole, making me destined to regain, and more, in mere months.* The thing is, I’m not “on a diet,” I’m just being more mindful of what I consume.

The act of breaking out of habit and questioning *by itself* will yield changes. The great thing is you don’t need to track every day or every month to get results. Once you have a fairly good routine, checking in every once in a while can keep you on track.

Restricting Can Backfire

You know what makes you really crave something? Being told you can’t have it. Crash diets do work, but they’re not sustainable. Telling yourself “no” for days, weeks, or months at a time make you more likely to say “YES” and overindulge, be it via Gruyere or Gucci.

One interesting observation over the past few years.

The people who recommend going all out, scorched earth on your non-mortgage debt repayment have often only been in or only will be in debt for 6-24 months.

A marathon runner has different strategies than a sprinter.

— Veronika | Debts To Riches (@DebtsToRiches) July 16, 2018

There are no “quick fixes” for long-term financial and physical (not to mention mental!) wellbeing. It takes time, effort, and being able to work with yourself and your limitations.

Personalization is Important

The best plan for me is likely not the best plan for you. And that’s okay.

You will not see me joining my workplace running group at noon in the heat of the summer for the following reasons: (A) The sun is my nemesis (B) I hate running (C) My knees no likey impact (D) Ugh, showering at work.

I *do* like walking with Fergus and listening to a great audiobook at twilight, Zumba, and weight lifting after a 1200 meter sprint on the rowing machine. The absolute best exercise is the kind you actually enjoy.

The same principle applies to personal finance; the best way to save money is to stop spending it on things you don’t care about. My friend Russell from RisdomFI and Nick True from Mapped Out Money just did a great couple of videos talking both about rejecting spending on “normal” things and getting disproportianate value on purchases that really matter to you, even if others think you’re crazy.

Even common nutritional “truths” need to be personalized. You know what blew my mind last week? Scientifically proven trends that different people react to the same foods in different ways. I’m not talking the “blood type diet” or other pseudoscience fads. This is something more complicated and trackable (thought sadly not that actionable for the public right now, as it’s…you know what, just watch the TED Talk and let me know if your mind was as blown as mine).

It’s Not Really About the Numbers

You could be right in line with a normal BMI but live on your couch and only eat twelve twinkies each day. You could also have millions in the bank and be absolutely miserable because seeing a psychiatrist “costs too much.”

The numbers of weight and savings are just numbers. They’re convenient to track, but they shouldn’t be the end goal. If you think everything in your life will be perfect if only you could quit your job and retire or if only you were model-esque, you’re simply wrong.

The other day, I bought an adorable fair trade cotton dress that I rock at my current weight. It cost $82. It’s very possible that I will be too small for it this time next year. But you know what? It brings me joy, and I’m not about to wait until I reach some arbitrary number before I can spend money on myself (plus, you know, alterations are a thing).

It’s all about balance and priorities.

Money (even debt) is about priorities. And you can prioritize more than one thing at the same time. This is why I aggressively pay off debt and still go on vacations. It’s OKAY not to prioritize extreme debt payoff over everything. #balance

— Wise Mind Money | Emilie (@wisemindmoney) July 16, 2018

If we were worried about reaching financial freedom as quickly as possible, we wouldn’t have gone scuba diving with my 80-year-old grandparents (twice!). If I wanted to lose weight as quickly as possible, I could simply not eat anything for a few months, be constantly hungry and tired, and do serious damage to my long-term health and wellbeing.

I don’t want to reach my “goal weight.” I want to have more energy, prolong my life, and give my knees a chance to live past 60.

I don’t want to retire as young as I possibly can. I want to give myself the freedom to pursue my passions and travel, while also giving back to my community.

~What is it that you really want?~

If you like the mashup of personal finance and fitness, check out the fitness challenge series Mr. SmartFI ran over the month of June, wherein a bunch of money nerds, including myself, set and mostly achieved weight loss goals (and of course compared it to personal finance).

*This isn’t a fully unjustified fear, as a preoccupation with calories and weight is one of the main signs of an eating disorder. If you have a history of disordered eating, do not undergo a tracking system or change anything without first consulting a professional. If you or anyone you know starts exhibiting any of these signs, call the National Eating Disorders hotline now.

Well done!! So glad he set up this challenge. I found it really motivating. Hope to meet you IRL in November!!

LikeLike

Thanks so much, Angela, and hell yeah I’ll see you in November!!:D

LikeLike

This!!!!! I love it! It’s crazy how financial systems we set up for ourselves can be applied to different realms of our lives. Very awesome. I recently started using the calories tracker on the Fitbit app and it’s insane to see how much mindless eating I do (especially when I’m bored!). Very similar to the mindless spending I used to do before tracking every penny! Keep up the awesome work and writing, beautiful words as always 🙂

LikeLike

Thanks so much ❤

Omg, it's mind boggling! I must have been averaging around 3000 calories a day that one year. Like, how?? Awesome the fitbit is working well for you!

Like, how?? Awesome the fitbit is working well for you!

LikeLike

Wow! Amazing progress on both counts! and you’re speaking at FinCon? That’s super cool! Keep up the good work!

LikeLike

You ever read a blog post and think that is exactly what I was trying to say but couldn’t. Well, Felicity, you said what I have been trying to spit out better than I ever could. BTW I love the pic of Flufster eating cauliflower. A dog after my own heart.

It goes without saying, but, thank you so much for being a part of the Healthy June Fitness Challenge. Thank you for the backlink and congrats on the Fincon speaking gig. I wish I could be there.

LikeLike

Shawn, you are far, far too kind — thank you! ❤

LikeLike

I love the weight loss graph. I was thinking a few months back… “Hey, you are getting a little chubby…. time to lose a few…” Nothing changed for months.

I then used MyFitnessPal to track my calories. I was shocked at how much I was taking in. Just being aware and quantifying the intact allowed me to start dropping “a few.”

LikeLike

Congrats on dropping the weight!! It’s crazy what tracking can do.

I’m not sure how long I’ll keep up more or less daily tracking, but I think I’ll definitely at least need to check in every once in a while to maintain a healthy weight.

LikeLike

Congrats on the impressive weight loss! That is one awesome chart (at least for weight loss, but if it reflected the market then not so much). “Magic? Nah, fam, math!” made me LOL.

Looking forward to hearing you speak at FinCon!

LikeLike

Thanks so much!

I’m still kind of amazed by how linear overall my chart is. It will eventually slow down and hit an asymptote, but I want to try to keep up the momentum while I can to get solidly in “ONEderland” territory. 🙂

Looking forward to meeting you at FinCon!

LikeLike

I totally agree with you that some things come naturally to us and others don’t. I love to work out but I struggle a lot more with the eating side of the equation. And I am naturally more of a saver than a spender. I’ve noticed sometimes that the cost of a food will deter me more so than the calories, when logically it should be the same. And I buy lots of rather expensive food from the grocery store because it helps me manage my calorie intake… I’m looking at you, Halo Top!

LikeLike

Oh man, 100% agree on the cost detering more than calories. Free or cheap food (plus, you know, sweet tooth) definitely contributed to my previous weight. I used to be much more concerned with lower overall spending, but now I’m much more balanced and prioritize health. 😀

LikeLike

This is so well written. I can’t understand why budgeting and saving comes so easily to me while sticking with a diet does not.

And, you’re right, my mind is blown by that TED talk.

Looking forward to meeting you in November!

LikeLike

Aww, thanks Liz!

It took me a *long* time, but I now find myself eating like I spend (occassional splurges, but mostly saying no to extra things I don’t need), which is bonkers to me. A huge part of it is habit, and another big part is just the mindfulness (which was only really possible for me after I started tracking).

Glad you also liked the TED talk! Fergus and I are considering getting one of those blood glucose testing tools and experimenting…him first, of course 😉

Yes, so looking forward to November!! 😀

LikeLike

Love this! I feel the same way, I eat just like my friends, have the same fitness schedule (aka we don’t work out), and even drink less alcohol than them… but I’m the only overweight one. It is frustrating that some people are naturally thin ha!

It is also frustrating that some people can cut out lattes & other small expenses, make $200k/year like it is nothing, and retire at 26, while I struggle to cut expenses to the bone and a job that pays over $40k/yr.

That’s a really good point that it is just easier for some, but doesn’t make it impossible for people like me that have to work extra hard on things.

Great post! Love, love, love the dog!

LikeLike

Fluffster loves you too!! Also wow are you doing a kick-ass job saving with that income.

Oh man, I highly recommend checking out that Secret Eaters series I mentioned, oh, and this mini documentary called The Truth About Slim People. In that mini documentary they had two slim people, who had always been that way, despite eating whatever they wanted and not being super athletes or anything. They measured their metabolisms, which came out as 100% normal, and then tracked their intake for an entire week. While they had 1-2 meals out with friends that were *very* caloric, their average calories per day were in the 2000s and completely consistent with their energy needs given their weights and activity levels. We can still be frustrated at our inability to be naturally skinny, but the real secret seems to be self-regulating hunger levels instead of super metabolisms. 😮

LikeLike

First time commenter here.

This is a great post. I really related to it. My own personal finance journey really picked up *after* my weight loss journey in 2015. I too used the FitBit tracking method and it worked wonders. My chart looked a lot like yours!

If it is any encouragement to you, I’ve managed to stick with it. I’m a little more lax on tracking – I sometime don’t track food intake on the weekend. I keep my step count up and hit at least 10k almost ever day. The results speak for themselves. If you’ve found a system you can sustain, I suspect your weight will stay off just like mine.

Good luck!

LikeLike

Thanks for sharing this post! When I was still dieting, I tried the advise of a friends – write what you eat. And so I did, I tracked how much do I really eat in a day and I became conscious about it, that most of it are unhealthy and sweets. so I eat lesser and healthier each day. Same thing goes with spending, I write my expenses from my allocated. There I monitored how much I spent vs. how much more money left in my purse. Even the littlest and simplest expenses I have to right it, even as small as a $1. That’s when I started pumping up my savings, with the use of manually monitoring expenses. I don’t want to ask myself again, “where did my money go?”

LikeLike

Hi Felicity,

I was pleased to meet you at FinCon. I wanted to weigh in 🙂 on the idea that finances and eating – in/out systems – are very similar. We were sponsors at FinCon and gave out t-shirts. We have been to other non-finance conferences. In the other conferences, we gave out the largest sizes and were asked if we had bigger than 2X. (No slam here, I’m in this category.) At FinCon we gave out a lot of smalls and mediums. Some larges and 1 or 2 XLs. Maybe it’s discipline? Or just being aware?

Just thought it was a fun link to the idea that they’re related!

LikeLike

There are so many of us who want, no, need to lose weight. And we usually jump onto the latest fad diet. The thing is, these quick fix weight loss methods are called crash diets for a reason: they are far from permanent. So why not try the permanent solution – health and fitness.

LikeLike

.

LikeLike

Great post. I agree, it’s definitely much more difficult to stay financially fit in the long term as you have to change the bad habits. It’s one thing to starve yourself of spending and pay off debt but then it’s another thing to stay out of debt and make sure you don’t rack it up again.

LikeLike