Today’s post is part of the Women Rock Money movement, with a massive 42 contributors at last count alone. Yes, that’s right, 42+ kickass women dropping knowledge today. While I haven’t been able to read the others at the time of this writing, as all the posts went live today at 6AM EST, but the snippets and titles alone make me question if I’ll be able to get any of my 9-5 work done tomorrow.

Disclaimer: Links to Amazon and Personal Capital are affiliate links.

You know who’s used to hearing often-conflicting advice about what they should and should not do in life? Women. We’re taught being fat is a crime punishable by spinsterhood, yet it’s somehow also our vain faults that eating disorders are on the rise. We’re supposed to lean in and be assertive at work, but only if we aren’t bitches about it. It’s exhausting and futile to try to satisfy all of society’s expectations. In a word, it’s bullshit.

In honor of International Women’s Day, I’m calling bullshit on one more thing, because personal finance rules are for dicks.

There are no blessed stone tablets of personal finance truth by which you need to live your life, and any expert that tells you your choices are wrong because they’re different is not an “expert” you should listen to. Hell, even “don’t play the lottery” isn’t one-size-fits-all advice, as there are undeniable exceptions.

We women are particularly judged for our spending choices, and on top of that, we still haven’t acheived pay equity with men (the wage gap is especially prominent for women of color), and we have to deal with the pink tax because apparently, we can’t use regular pens? [Real talk: do yourself a favor and read the comments on those “For Her” pens—comedic gold]

You don’t believe me? You think the “experts” are right and anyone who disagrees is just whiny, jealous, or playing the victim?

This is going to be fun.

BS Rule #1 Anyone Can Save a Million Dollars, No Excuses

This is not an exaggeration of personal finance advice. Real dicks people say this without any sense of self-awareness and have even specifically called out disability and divorce as illegitimate excuses.

First off, this is straight up factually incorrect. If you are an individual with a disability receiving public benefits, you are legally not allowed to save anywhere close to a million dollars without losing benefits. Currently, because of the 2014 Achieving a Better Life Experience (ABLE) Act, eligible individuals can save up to $100k. Before 2014, and for those not eligible for an ABLE account? No more than $2k saved before being cut off. These means-testing programs force families to stay in poverty, and even the long process of applying for disability in the first place is mentally and physically taxing.

Most personal finance bloggers and experts would have heart palpitations if their checking accounts dipped below $2k. Making sweeping statements and generalizations as an able-bodied, high-income earner is as disgusting as it is profitable.

BS Rule #2: You Need to Save X% of Your Income or Have $XXX,XXX by Age Y

I get the impetus for rules like these. Really, I do. Guidelines give us a sense of where we stand in this “shades of gray” world, with the certainty of ye olde letter grade from school. But these rules are a disservice to people on both ends of the personal finance spectrum. It’s like teaching physics without calculus: If you don’t understand the underlying concepts, all you’re doing is memorizing equations.

Any savings percentage or age-based rule ignores the reasons for saving, as well as the specific constraints of the individual.

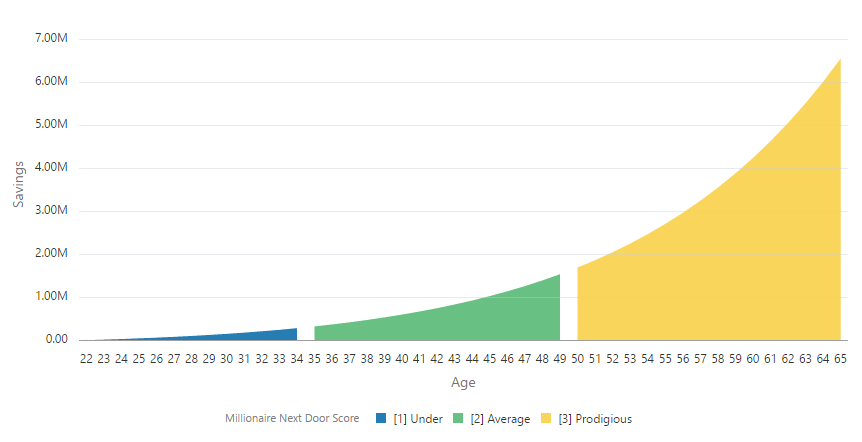

Allow me to introduce the equation I most love to hate. In the book The Millionaire Next Door, Thomas J. Stanley introduces a wealth equation to determine if you are an Under Accumulator of Wealth (UAW), Average Accumulator of Wealth (AAW), or Prodigious Accumulator of Wealth (PAW). Even for the math-shy, this is a super simple formula:

You are an Under Accumulator of Wealth (UAW) if your net worth is less than [your age] * [your income] / 10

You are a Prodigious Accumulator of Wealth (PAW) if your net worth is higher than [your age] * [your income] /5

Math! That means it’s time for some graph action up in here.

Graph: How a Constant 20% Savings Rate Can Be Simultaneously Awful, Average, or Amazing According to a Stupid Formula

The above charts an above-average person (let’s call her Jill) graduating from college at 22 with a salary of $55k, annual 4% raises, a constant 20% savings rate, and 8% annual growth on investments. Jill is a UAW until age 35, an AAW up til age 49, and a PAW from 50 on. In fact, unless you’re a trust fund baby or are similarly blessed, there’s virtually no way to start out as anything but a UAW in your twenties. Could a formula be any more useless?

To be fair, Stanely has stated that the equation is not meant for people much younger than 57, and that any time spent in something like Medical school should be subtracted from your age in the wealth equation (e.g. if you’re 56 and spent four years in medical school, use age 52 in the equation).

The problem is, this equation fails on both ends, as it doesn’t take into account the magic of compound interest or even the idea that saving a lot of money is Not The Point.

Look, I love money, but not because I have Scrooge McDuck fantasies. I love what money can do for me. Fergus and I are planning to retire at the ages of 29 and 35 to travel the world and focus on random projects without the need to profit (we’re notoriously bad at profiting). Using standard financial advice, I’d never have considered retiring before 50.

As another example, take a look at Gwen from Fiery Millennial. She’s walking away from 9-5 work at the age of 28 to take a risk and work for herself pursuing her side hustles full time. That is amazing! It’s also not something any sort of metric or rule of thumb was made for. That’s okay because Gwen is too badass for metrics anyhow.

As far as I can tell, the best use of these sorts of personal finance rules is for high-income dicks that just want to feel better about themselves.

BS Rule #3: Spending Money on Makeup or Fancy Clothes is Stupid and Frivolous

There’s a stigma around “girly” purchases. Spending money on personal appearances is vain and silly, but a fancy new Tesla only ever seems to get compliments.

In case you haven’t noticed, I’m a fan of math and facts, which is why I have no qualms saying buying and wearing makeup could actually increase net worth over time. Makeup alters perception, and almost always in a positive light. Wearing makeup could be one of the easiest and most rational things to do when preparing for a job interview, and the same could even be said for designer clothes.

And hey, if spending money on quality clothes that will last for years (while simultaneously promoting good labor practices and being environmentally conscious) is frivolous, sign me up.

More importantly, though, who cares? Just as your health is between you and your doctor, I’m going to leave the responsibility for your financial health between you and your accountant or you and your family. What kind of dick cares about how you spend your money?

Dick-Free Personal Finance Advice

Want some general advice to help you out in your own jouney to financial freedom?

- Write out your goals and values. What is it you want out of life? Do you want to travel the world, become a philanthropist, paint all the things, open a bed and breakfast, eat lots of chocolate?

- Get to know your spending and income. Tracking your money is a scary but eye-opening experience. Even if you think you know how much you’re spending each month, you might be very surprised. Use Mint or Personal Capital to make it a little easier, and see if your spending aligns with your values.

- Make a plan. Are you going to cut down on eating out? Start an emergency fund? Are your expenses higher than your after-tax income?

- #1GoodMoneyThing. Don’t get overwhelmed and think you need to change everything at once. Doing one small thing to help your financial life now is infinitely better than ignoring your finances.

That’s it, y’all! Oh, and make sure to abide by Wheaton’s Law at all times.

Do you have examples of bad personal finance advice? Let us know in the comments! Or, if you’d rather stay positive, we’d love to hear about your goals and how you’re working towards them!

How can I emphasize how much I like this article… thank you!!! I find many of the personal finance “rules” fine advice for a small set of people, but certainly not all-encompassing or applicable to most situations. Happy International Women’s Day!

LikeLike

Awww thank you so much!!

I had so much fun (and more than my usual amount of “Aaah does this only make sense in my head??” feelings) while writing this. I’m so glad the concepts translated and ring true, especially to another kickass woman questioning all the “suppose tos.” Happy International Women’s Day!

LikeLike

I’ve never laughed out loud at a personal finance post before, but the FFF Wealth Indicator had me giggling. I love this post and your efforts to be inclusive of all women!

LikeLike

Yessss I love our indicator!! So glad you liked it!

This is literally how it came to be:

Fergus: “The UAW/AAW/PAW makes no sense. It’s like saying, ‘If you’re less than five, you’re good.'”

Me: “Five what?”

Fergus: “Who cares? It’s all equally stupid.”

*BOOM! Best new indicator is born* XD

LikeLike

OH MY GOD YOU ARE MY FAVORITE PERSON! This is beautiful. Submitting to Rockstar.

LikeLike

Awwww bae ❤

You rock, like, so hard.

LikeLike

YESSSSSSSSSSS this is every bit as excellent as I thought it was going to be! It’s kind of hilarious that you mention makeup may raise your net worth (an excellent point, actually) since I talked about hardly ever wearing it in mine. Given that your FFF Wealth Indicator says I’m failing at life, maybe I should rethink the whole no makeup thing 😉

Also, ahem, I’m TOTALLY getting a lot of work done at the 9-5 today… (Don’t care. This is a way better use of my time!) Happy International Women’s Day!

LikeLike

I’m so glad the post didn’t disappoint ^_^ ❤

Haha, I actually also rarely wear makeup (like, maybe half a dozen times a year?) — but I will defend any woman's right to wear it, especially if it can fight the patriarchy by helping to close the pay gap! (and the indicator can be a cruel mistress, but the results are undeniable and can never be changed — so sorry!)

Same here on the work at work bit, 'cause I'm DEFINITELY not just stalking Twitter and reading all the posts…

LikeLike

I definitely L’edOL a few times here 🙂 I’m so glad we are finally coming around to the “personal” in personal finance… everyone is coming from different backgrounds, upbringings, belief systems, ambitions… we don’t all have the same, or even similar, desires out of life. Your ideal “retirement”, to me might sound horribly boring or exhausting. Get off your high horse and stop waving around your dick of righteousness, and recognize that everyone makes their own life decisions… and that’s okay!

LikeLike

Haha, glad to hear it!

Yes! Personal finance is *so* personal!! But flashy “this is what you should do” or “anyone can do this” headlines get more clicks in this messed up world of ours (not that I’m in a place to complain about click bait titles given what I called this post…)

(not that I’m in a place to complain about click bait titles given what I called this post…)

Love your point about someone else’s ideal retirement being horrible to someone else. I am so not meant for #vanlife, but it’s awesome for a lot of folks. *sing song* To each their own ^_^ *end sing song*

LikeLike

Laughing so hard at this! Thank you for the humorous approach and some real talk.

LikeLike

^_^ You’re so welcome!! Thanks for reading and commenting. 🙂

LikeLike

I love this post!!! So real and enjoyed all the math and physics related comments. I’m a fellow nerd and engineer 🙂 Solid advice – it can get so overwhelming when you feel like you need to change everything all at the same time. I constantly have to remind myself to pick the one thing that can move the needle the most and focus. Thanks for keeping it real, Felicity!

LikeLike

Doodlepops are in the house!! Hey girl hey!

Haha, super glad you appreciated the nerdy comments 😀

The feeling of being overwhelmed is so relatable. It’s also one of the reasons I want to slap some of the people chastising the choices of “poor folks.” If personal finance can be overwhelming for highly educated nerds like us that like this sort of analysis and write about it for fun, how insanely overwhelming would it be for someone who’s not sure they’ll have food on the table and only has a high school education? Maddening, some of those folks — absolutely maddening.

LikeLike

This post is just awesome. Yes, indeed. I’ve always hated that damn Millionaire Next Door formula. Thanks for saying it.

LikeLike

Aww, thanks Laurie!!

The Millionaire Next Door formula is *so* bad XD

Ours is way better 😉

LikeLike

I love this so much! I constantly battle with voices in my head/the PF internets telling me what a failure I am because of my low net worth. NONE OF THESE PEOPLE, however, worked in nonprofits like I did for the first 4 years out of college, followed by three years of law school, followed by more work in the nonprofit sector as a lawyer because I had crazy notions of helping people. For my net worth, this was a bad series of choices. But I felt good about it. Some days I still feel good about it. And regretting the fact that I still don’t make what I thought would be a reasonable starting salary out of law school 10 years ago (because of Reasons) doesn’t actually do a damn thing to change where I am now. So forget the dick advice is the best advice!

LikeLike

Yes, yes, yes, 100% yes!

You are an amazing person who spent the most valuable asset you have, time, helping other people. If there were a “human worth” scale, you would top it. Scratch that, I’m making up a Human Worth Scale right now, and you’ve scored an 89 (which is super weird, because the scale maxes out at 50; you’re just that awesome).

Thank you for reading, commenting, and most importantly, being you. Screw the dicks!!

LikeLike

Oh my gosh, this post! Bahahahaha! My favourite from the WomenRockMoney collaboration so far! Epic!

LikeLike

Awww, thanks, Kristine!! That means a ton since there are so many epic posts ^_^

LikeLike

Bahahahaha that calculator is pure GOLD. And the “save a million dollars” discussion is so so important. No way does everyone have the same platform to work with.

LikeLike

Hehehe ^_^

I’m so glad we made that calculator. Kind of wish we logged the results, to see what numbers people were putting in, though…there are only three possible results right now, and the majority is of course “you fail at life” XD

And omg — every time I see someone go on about how easy it is to be a millionaire, I’m afraid my eyes will roll out of my head.

LikeLike

I’ve seen you wear makeup. LOTS of makeup. So much, in fact, that you left it on the floor and sink countertop in the FinCon17 hotel room.

Hahahahahaha….Now let me clear that up for those following along at home: Felicity FFF dressed as the defiant girl statue from Wall Street for the FinCon Halloween party.

Now back to our regularly scheduled programming: I love this post because numbers are our friends but numbers can also be bullshit. I’m particularly aggravated by the talking heads who say “you must have six months/12 months/24 months of living expenses saved or you are DOOMED.”

Obviously we need emergency funds, but why make people feel defeated before they start? How many folks with student loans and starter salaries have seen this advice and thought, “I can’t even imagine saving THREE months of expenses so I guess I’m hosed.” And how many of them give up?

I’m with Liz Weston, who says that even a $500 EF can make a big difference. So aim for $500 and, inspired by your own badass self, keep going. That’s why I offer a free PDF of the “Challenge Yourself to Save” chapter of my first book to anyone who asks. I make this offer in the second book, in guest posts and on podcasts — no strings attached, no being spammed to buy stuff. That’s how much I believe in EFs.

(If anyone wants the PDF, request it at SurvivingAndThriving (at) live (dot) com.)

LikeLike

That was such a great night! Haha, and I’ve still got a ton of that metallic makeup leftover that I’ve got to find a use for, in case you’d randomly like to have a silver face in the near future. 😉

Emergency fund advice is especially messed up so much of the time, it’s true! Any advice that leads to people feeling ashamed and unable to do anything right is terrible advice. Love that you offer that free PDF chapter!

LikeLike

Fantastic post!!

It’s so hard for PF bloggers (myself, a dick, included) to think outside their own circumstances and offer advice that applies universally. Rules be damned: money is a tool to make one’s life better. I do think there are situations where one path is more optimal than the other, but it’s entirely up to the individual to determine if financial advice is applicable.

This post has inspired me to be more considerate with how I approach my writing. Thank you for the refreshing reminder to keep in mind the wide variety of readers out there.

LikeLike

I love the takeaway, Jack! Thanks so much for commenting and letting me know this post made you think.

We’re all dicks sometimes and can only strive to be better. ^_^

LikeLike

OMG this is my FAVORITE post I’ve read in a long time. I’m tired of feeling like a failure because I don’t have X saved in my IRA. I’m doing better, but for a long time this held me back from even trying. I think more people need to see this message!

LikeLike

Awwww, thanks, Lindsay!! ❤

It's such a normal human reaction to think, "Well, I can't do that, so why even bother trying." We're not robots, and any financial advice (that's actually trying to help someone, as opposed to being pure clickbait) should take that into account. 🙂

LikeLike

Okay first, thank you for that Bic Pen comment section recommendation.

Second, WT actual F? We PUNISH people for being disabled and good with money? Whyyyyyyyyyyyyyyyyy

LikeLike

My favorite was the one talking about randomly leaking ink once a month. XD

And yes, it’s so messed up! With the Affordable Care Act / Obamacare, and with the ABLE accounts, it’s gotten much better…but still not great by any means.

The system was designed by people who wanted to make sure no one could abuse it, but it’s ended up as a bureaucratic nightmare for all and an incentive to stay poor for some.

LikeLike

I loved this article, you did a great job. You made some really good points and it has had me thinking a lot the last few days.

I was thinking about the traditional path to FI and how it isn’t really challenged despite the fact that most people will continue to work (maybe not right away or in the same field). Even working part time is an option so why not start sooner and actually do what you want to instead of waiting till you have nothing to do? I think it should get a bit more time in the sun.

I really like your writing, it’s helped inspire me this week.

LikeLike

Awww, thanks, Russell! I’m glad this post helped inspire you.

I’ll look forward to hearing what you’re going to come up with. 🙂

The One True Path to FI is something I’ve been thinking about a ton lately. Fergus and I might reach “our number” this year, but we probably won’t *retire* retire for a while more…and we’re both actively working on getting better work situations that we enjoy more vs. just looking for maximum money. If I actually started making money from this blog, though? As in, enough to cover some significant portion of our expenses? I could see quitting early and focusing on that. Could I actually be making money here in a reasonable amount of time if I was able to spend 20+ hours a week on it? Who knows! For now, I’m happy enough to continue and might eventually work out some sort of digital nomad or part-time work arrangement in the near future.

LikeLike

The most annoying personal finance advice I can think of is the blanket “save XXX dollars for your emergency fund”. IMHO your initial emergency fund should be relative to your expenses. A blanket number is just a token. I appreciate the sentiment behind it, but I disagree haha.

LikeLike

I’m so glad I found your blog! This is a real eye opener for me! Fab post. The worst financial advice I had was “your finances are over now you have a child, I wouldnt worry about opening a savings account” – from the bank manager!

LikeLike

Best title ever!

And thanks for calling out the Accumulator calculation, when I first came across it it made me so scared. Like, I save 50% of my income, how am I not a PAW?! Until I read more about it I was feeling rather bad about myself, and imagine that other people might experience the same thing

LikeLike