Recently I’ve had the pleasure of corresponding with an absolutely lovely young couple that wanted some advice. For anonymity’s sake, let’s call them…Amelia and George. Amelia and George are wonderful savers, partially due to necessity right now, as George is a full time student and Amelia is the current breadwinner with a small salary at a nonprofit. They both have sizeable side-hustles that are bulking up their income, but money is tight.

And they really want a house, possibly even a tiny house. Oh, and they have no credit score to speak of. Oh, and they may have to move in two years after George has graduated. Oh, plus, since we first started communicating months ago, a decision has already been made – the suspense!

The Details

| Income | $35,000 | Nonprofit salary + two side jobs |

| Spending | $24,000 | $850 monthly rent |

| School Tuition | $9,000 | Graduating soon!! Congrats! |

| Liquid Savings | $27,000 | Not including retirement & emergency |

In addition to rent being over 40% of their spending, they really hate their apartment. Torn carpet, cracked tiles, and stained grout – simply bad maintenance by the landlord. Amelia and George are pretty desperate to get out, build equity, and have pride of ownership. They’re considering all their options: Single Family Home, Multi-Family Home (for rental income), and possibly even buying a plot of land and a tiny house.

Decisions, decisions! (CC BY 3.0 US) Individual icon attribution: Multi-Family House by B Harper, Tiny House by Timur Zima, House by Noun Project, Rent Check by Musket, Question Mark by unlimicon.

Now, the really frustrating thing about this situation is the real estate market in their town, in that you could easily get nice returns as an investor. Fergus and I live in the Boston area, and basically no houses on the market make any sense as investments when looking at basic real estate investing guidelines like the 2% rule, nor would they even be cashflow positive.

Actually, let’s run the numbers for a property near us in the Boston area to see how awful they are for investing. There’s a full house for rent nearby us for $2300 – 3 bedroom, 1.5 bath, nice yard. Looking at sale records from the past year on that same street, the house would probably sell for $350k-$400k (which is lowish to begin with around here). Like every other property we’ve looked at, the monthly rents are way less than 1% of the purchase price. If we assume $350k, the mortgage + property taxes + insurance would be over $1,700 monthly.

Now if we…actually, let’s just have a calculator do all this hard work for us.

By the way, we made a calculator! We were frustrated by the lack of options out there for quickly trying to figure out cash flow and the like, so we made our own. And here’s the link to the *Best Case* analysis of the house nearby. Assuming a measly 5% of rents go towards maintenance, and the property is completely owner-managed, and the occupancy rate is 11/12 months a year, the property is still cash flow negative. There’s a reason we still rent.

Now, let’s contrast this with the properties Amelia and George are looking at:

| 4-Plex | $225,000 |

| 3-Plex | $180,000 |

| Single Family House | $130,000 |

| Tiny House | $70,000 |

Market rent for most of the 3-Plex and 4-Plex units would be anywhere from $650-850. Both the Multi-Family properties easily surpass the 2% rule. Now, this doesn’t mean they are definite buys, as they could be seen as very risky, depending on the area. At any rate, you can easily see why Amelia and George would want to stop renting and buy.

First Feedback

I first wrote back with the following advice, several months ago:

My initial reaction is:

(1) If I were living there, and planned to continue living there for 3+ years, I would look into buying, and likely buying a 3-4 plex

BUT

(2) With no credit, and your current income, it would be both difficult to finance a home and riskier to buy and be a landlord. On top of that, with a fairly high likelihood of moving in two years… I would not personally be comfortable with that level of risk. The thing is, it could turn out great if you buy – could have no major repairs come up, and get amazing renters – or it could just turn into a fiasco that requires funneling more money than you have on hand into the property.

Tiny Home

On the tiny home question, you might want to look into used homes on the tiny home site on this list of resources. I don’t have super hard facts and statistics on this, but it looks to me that tiny homes depreciate faster than a typical mortgaged property. (Buy used if going this route!)

Single Family

Turning to the rent vs. buy calculator from the NYT, a single family home would lose you money if you moved in two years, due to costs related to buying and selling.

Multi-Family

I haven’t fully done the numbers on a 3-4 plex yet, but this list also has a link to the Bigger Pockets forum with a downloadable spreadsheet.

It’s definitely important to note some general landlording assumptions. When buying investment properties, you typically factor in only 75% of rents, to account for vacancy and the like. In addition, you have maintenance on top of that.

Plus, if you bought a 3-4 plex and then moved, it looks like you would have to refinance it (as you would likely start off with an FHA loan), in addition to hiring a property manager. Basically, it’d be a whole lotta hassle.

Renting

One question Fergus and I had when going through these numbers is why is the rent so high? Would it at all be possible to look into using your network to snoop around for a better deal?

So What Did They Do???

Amelia and George are very proud owners of a duplex.

| Duplex Price | $82k |

| Pre-approved (HUD) | $150k |

| Market Rate Rent | $800 – $850 / unit |

Doesn’t that table just look so pretty? Ah, if only it was that easy for George and Amelia.

You see, the HUD mortgage they were pre-approved for was not to be used on multi-family properties. Every lender they called said, “Oh, sure, we can make this work,” only for our friends to be let down. Their bid was accepted, but they no longer had a way of financing the property.

Because George and Amelia are amazing and hardworking, they were actually able to partner with friends of the family that were looking to diversify their investments. Amelia and George put in $50,000, digging deep into savings, and their new partners put in $50,000, allowing them to buy the duplex with cash. Now they are hard at work getting the property renter-ready with the remaining stash.

These partners are essentially receiving 6% interest on their $50,000, and will see 50% of the profits on the sale of the property. 6% interest on a private business loan is a pretty good rate by itself, only slightly higher than Lending Club’s current lowest rate at 5.9% for the most qualified. All rent proceeds and any additional maintenance will be handled by Amelia and George. Now, let’s stop talking and run the numbers!

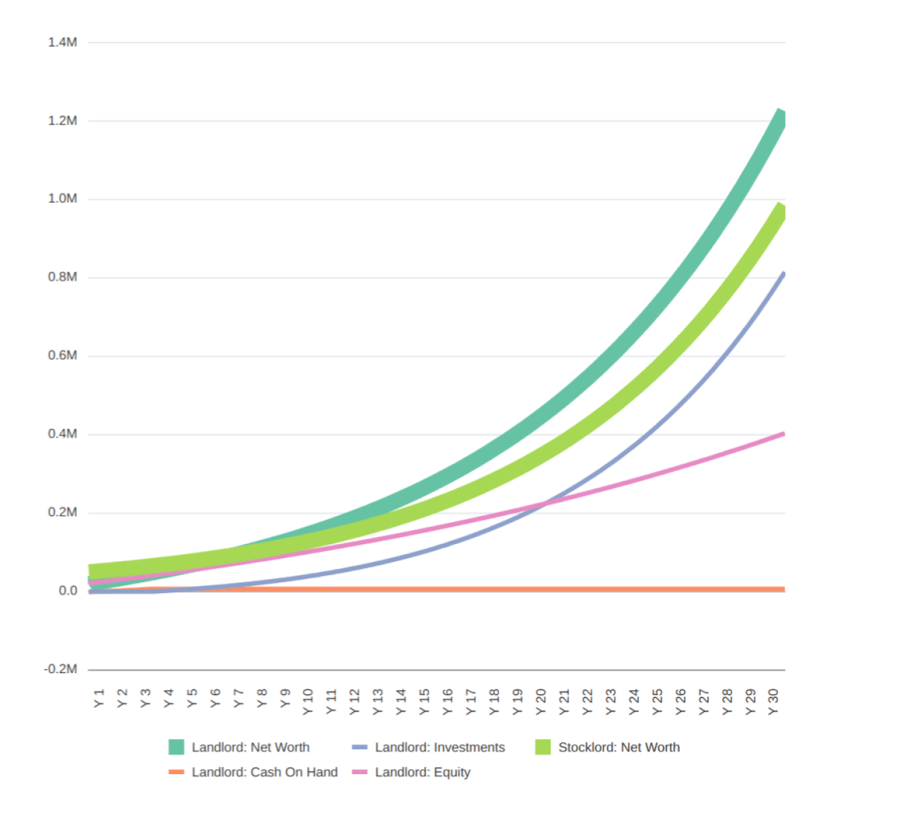

Even after putting in 55% for the assumed costs of selling (given 50% of sale goes to partner), the graph looks very rosy indeed. This graph is assuming a mortgage payment for the $50,000 from the partner, for simplicity’s sake.

The cash flow on this is just fantastic, regardless – estimated by the calculator at $822 per month, or $872 after correcting for the simplification (using interest-only payments). Essentially, George and Amelia will be living “for free,” and will be able to bank the $850 in rent they are currently paying, after accounting for all expenses*, and using relatively conservative assumptions.

Worst Case Scenarios

Fergus and I just kind of naturally think of the worst case scenario in life, just to be cautious.

We met online, and during our first in-person meetup, Fergus told me that beforehand he concluded the worst case would clearly be me mugging him and leaving him by the side of the road. And he still chose to meet me – isn’t he sweet?

So, here’s what we came up with (and solutions when applicable) for worst case scenarios:

- Bad tenants – huge legal battle and months of loss rent and damage to the property [screen, screen, screen!]

- Need to sell early on for relocation and housing market tanks

- Investment Partner wants out in the first year and you are unable to pay back the principal [might want to look into a home equity line of credit, just in case]

- More repairs needed than originally expected / run out of savings

- Unable to rent at $850 or even $800 (maybe big employer in town closes up shop, etc), making you cash flow negative or neutral and having to bank on equity gains that also might be less likely now

Good Luck!

The numbers seem to be on their side, and it’s possible this is just the beginning of their real estate empire.

Have you had similar experiences? Advice for the young couple? Real estate empire dreams of your own? Let us know in the comments!

*For owner-occupied multifamilies, the calculator adds the current rent paid by the potential owner to the cash flow. The cash flow is the net cash flow difference between owning a multifamily (living in one unit) and continuing renting.

Good luck Amelia and George! I would be loathe to buy a multi-family with so little cash on hand, but it seems like they’re making it work. I can for sure understand the lure of multi-family rental properties and getting to live for free 🙂

LikeLike

It’s true, it’s risky in the short term — we also wouldn’t be comfortable without a good amount of cash on hand. Risk-wise it would probably be similar to retiring, actually, where the first year will be really crucial to long-term success. If they are able to cash flow early on, Amelia and George can build that emergency fund up again to cover any long-term vacancies or major repairs.

LikeLike

As tiny-ish house owners, the potential for depreciation is real, so buying used would be a good idea. We plan to rent this house, so we’re not super concerned about depreciation. Like Gwen, I’d be concerned about buying anything with so little cash, esp. with all the inevitable repairs. Best of luck!

LikeLike

I wasn’t able to find any actual numbers on depreciation, so I’m glad my inkling on tiny house depreciation was not completely false! I wonder if people are more likely to be picky with smaller houses since there is so little space to work with? With larger houses it may be easier to forgive an imperfect layout.

It definitely will be risky in the short term, before they’re able to regrow a nice emergency fund. Hopefully it will all work out, though! I’ll be sure to post updates in the future, as well. 🙂

LikeLike

I’m only guessing, but I’m sure you’re right. There really isn’t any way we could reconfigure our house, just add on if we wanted.

LikeLike

I’m interested in picking up some more real estate. I have a house now with some roommates who pay me rent, but haven’t pulled the trigger on #2. Right now, I’m focusing on my blog and other side hustles…

Thanks for sharing this in-depth analysis. As a math guy, I loved it!

LikeLike

Glad you enjoyed the post, and that you’re a fellow math nerd (sqrt(-1) ❤︎ math)!

Especially since you’re invested in real estate, definitely let us know if you have any feedback on the Landlord vs. Stocklord calculator — it’s still in beta and we’re sure there are lots of little things keeping it from being a super awesome resource. 😀

LikeLike